Revolutionize Your Home and Auto Insurance Workflow with Innovon.ai’s MailAI Quote

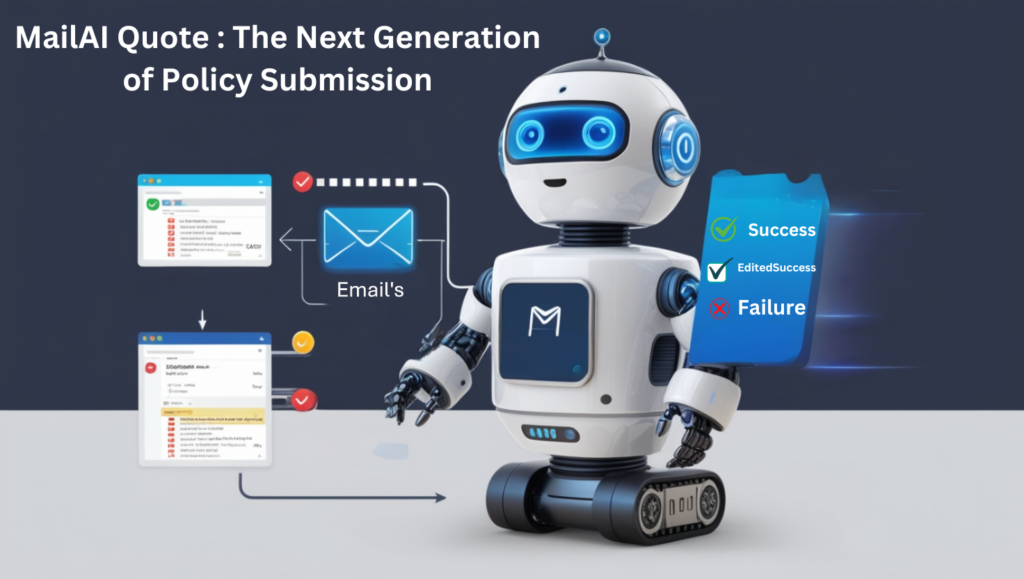

The Next Generation of Policy Submission

Unlock the power of AI-driven innovation with Innovon.ai’s MailAI Quote platform, designed to streamline your home and auto insurance workflows and revolutionize policy submissions. This cutting-edge solution enhances accuracy, reduces manual tasks, and dramatically boosts efficiency, empowering your team to work smarter and provide superior customer service. Experience the future of home and auto policy submission with MailAI Quote, a powerful tool built for tomorrow’s insurance world.

AI-Driven Email and Document Processing

- Extracts essential home and auto policy data from emails and attached documents with exceptional precision.

- Automatically categorizes submissions into Success, Failure, or Edited Success for seamless tracking.

Broad Document Compatibility

- Supports a wide range of formats, including PDFs, Word documents, and text files.

- Ensures critical data is extracted and organized for efficient home and auto policy creation.

Simplified Workflow Management

- A user-friendly interface for reviewing, editing, and resubmitting failed home and auto submissions.

- Real-time status updates provide complete process transparency.

Seamless Integration with Leading Insurance Platforms

Effortlessly integrates with:

- Guidewire

- DuckCreek

- Mainframe Systems

- COTS Products

- Flat File Processing

Optimized for Home and Auto Insurance

Specially designed to simplify home and auto policy submissions, enhancing agent productivity and workflow efficiency.

Advantages of Choosing MailAI Quote

Faster Processing

- Reduces manual processing time by 85%, enabling quicker home and auto quote generation.

- Empowers underwriters to focus on decision-making rather than data entry.

Enhanced Accuracy

- Achieves a 95% accuracy rate in extracting home and auto policy details, minimizing errors and compliance risks.

Always-On Automation

- Operates round the clock, ensuring timely processing without delays.

Superior Customer Experience

- Instant updates on home and auto submission statuses foster trust and transparency.

- Faster responses lead to improved customer satisfaction and loyalty.

Why MailAI Quote Stands Out: A Comparative Advantage

MailAI Quote isn’t just another automation tool; it’s a revolutionary AI-powered platform that outperforms traditional home and auto submission workflows in speed, accuracy, and efficiency. Here’s how it compares to conventional methods:

| Feature | Traditional Workflow | MailAI Quote |

| Processing Speed | Manual data entry causes delays. | Reduces processing time by 85% with AI. |

| Error Rate | High due to manual inputs and human error. | Achieves 95% accuracy in data extraction. |

| Document Handling | Limited to specific formats. | Processes PDFs, Word, TXT, and more. |

| Integration Capabilities | Difficult to integrate with modern systems. | Seamlessly integrates with Guidewire, DuckCreek, other COTS products, mainframe systems, flat files, and more |

| Operational Costs | Requires more manpower and resources. | 70% cost reduction with automated workflows. |

| 24/7 Availability | Dependent on business hours. | Always-on automation, no delays. |

| Submission Classification | Requires manual review and categorization. | Automatically classifies submissions as Success, Failure, or Edited Success. |

Impact of MailAI Quote

Before MailAI Quote:

- Time-consuming manual processes.

- High error rates leading to delays.

- Frustrated customers and inefficiencies.

After MailAI Quote:

- Lightning-fast AI-powered processing.

- Accurate submissions reduce compliance risks.

- Improved agent productivity and client satisfaction.

Features for Home and Auto Insurance Providers

1. Categorized Submission Tracking

- Success: Processed without issues.

- Failure: Highlighted for required corrections.

- Edited Success: Tracks resolved and resubmitted submissions.

- Advanced Error Handling

- Automatically flags missing data in failed submissions.

- Provides editing tools for quick resolution and resubmission.

- Comprehensive Dashboard

- Visualizes submission metrics such as success rates, failures, and processing times.

- Delivers actionable insights for process improvement.

- Document Versatility

- Handles formats including PDFs, Word files, scanned images, and more.

Real-World Results with MailAI Quote

| Metric | Achieved Value |

| Manual Processing Time Reduction | 85% |

| Data Extraction Accuracy | 95% |

| Operational Cost Savings | 70% |

| Availability | 24/7 automation |

Conclusion:

MailAI Quote transforms the home and auto policy submission process by leveraging AI technology to streamline workflows, enhance accuracy, and reduce manual data entry. It integrates seamlessly with key systems like Guidewire, DuckCreek, and mainframe systems, enabling businesses to modernize their operations.

With 24/7 automation, real-time tracking, and robust error handling, MailAI Quote boosts agent productivity and customer satisfaction. Its ability to categorize submissions and handle various document types ensures comprehensive processing. Designed for both modern and legacy systems, MailAI Quote simplifies workflows, reduces costs, and helps insurance providers focus on improving service and growing their customer base.