It always starts the same way.

An email lands in someone’s inbox—subject line: “URGENT: Claim Notification – Water Damage.” There’s a PDF attached, maybe a photo or two. The adjuster’s morning coffee is still warm, but their day has already gone sideways.

The document is incomplete. The policyholder forgot to include the policy number. The body of the email is a wall of text—no clear indication of what actually happened. Somewhere in the attachments is a vital piece of information, but good luck finding it in the next 10 minutes. And somewhere in a different department, someone else is manually entering the same info into a spreadsheet.

This is not a one-off. This is every day in the P&C insurance world.

Let’s Stop Pretending This is Fine

Behind the clean branding and digital portals, most insurance operations still run on duct tape and goodwill. Processes are deeply human, highly manual, and terrifyingly fragile.

“We’ve always done it this way” is still the loudest voice in many rooms.

Agents are copy-pasting customer info into CRM systems. Claims teams are stitching together facts from emails, call logs, and blurry PDFs. Underwriters are waiting three days to get one document verified, while customers get impatient. Everyone knows it’s broken. But few know where to start fixing it.

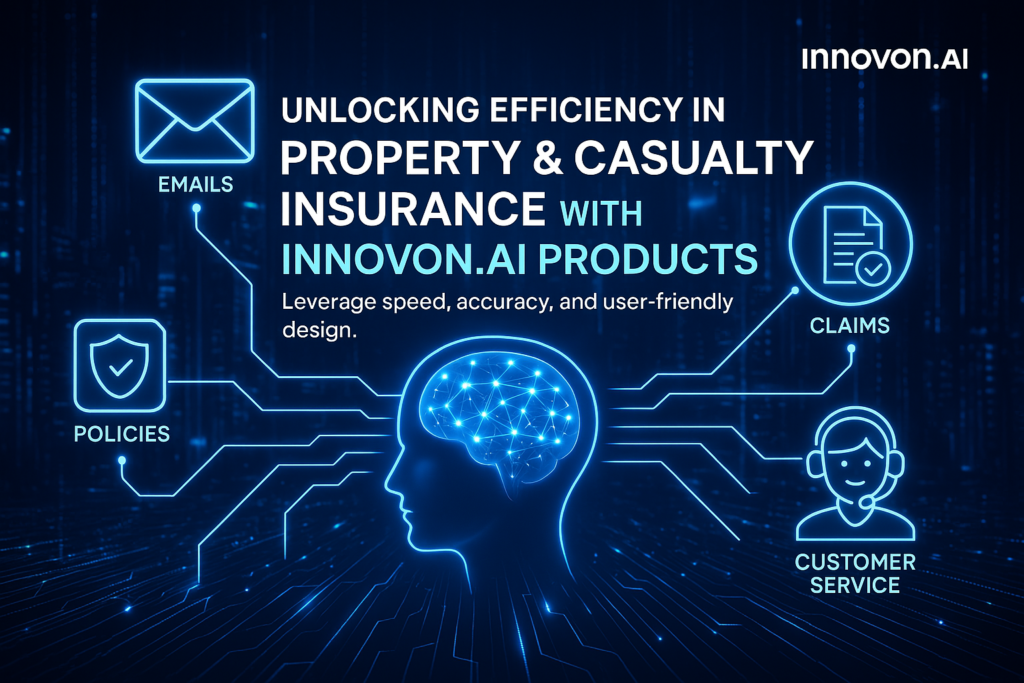

AI Isn’t a Product. It’s a Perspective Shift

Forget AI as a shiny dashboard or a chatbot gimmick. The real revolution is quieter. It’s not about replacing people—it’s about removing the friction that slows them down.

What if:

Claims emails were parsed before they even reached a human, with missing fields highlighted and filled based on historical data using MailAI

Underwriters saw only clean, structured data instead of five versions of the same scanned document, processed using DOCAI

Teams had a full picture of any claim or policy—not scattered across tools, but stitched into a single, real-time view powered by Smart Portals.

These aren’t futuristic ideas. They’re already happening—just not fast enough.

AI isn’t magic. But it’s really good at what humans hate: repetitive sorting, data extraction, finding patterns, remembering everything. If we gave it the grunt work, people could focus on conversations, decisions, empathy, and strategy.

We Don’t Need Another Dashboard

Let’s be real: insurers don’t need “one more tool.” What they need is interoperability—tools that talk to each other, work quietly in the background, and make people’s lives easier without fanfare.

An underwriter shouldn’t have to learn five new systems to do their job. An agent shouldn’t need to click 17 times to find a policy document. A claims team shouldn’t live inside email threads and Slack messages just to stay updated.

This is exactly where tools like InsurAIAdmin Platform come in—not by adding complexity, but by simplifying visibility across agents, claims, policies, and reports, without making anyone change the way they work. The best technology in insurance will be the kind you barely notice.

A New Kind of Collaboration

This isn’t about one company solving everything. It’s about changing the culture of insurance to embrace collaboration—with AI, with platforms, and across teams.

Some insurers are already experimenting with:

-Innovon Virtual Agent (Ivan) for guided intake and claims handling.

– Policy Intake Portal for simplifying new policy submissions with built-in intelligence.

– Real-time visual dashboards and location-aware insights via the InsurAdmin Dashboard.

They’re not using buzzwords. They’re using intelligence as infrastructure.

These quiet upgrades are doing more for customer experience than any chatbot ever did.

So, What’s Next?

The future isn’t a big bang. It’s a slow fade-out of chaos.

– Fewer “Can you resend that form?” emails.

– Fewer hours lost in manual entry.

– Fewer customers frustrated by the silence between submission and resolution.

And more:

✅ Time for strategy.

✅ Room for innovation.

✅ People doing what only humans can do.

The goal isn’t to be “AI-powered.” The goal is to be clear, fast, and human-first. AI just happens to be the best way to get there.

Insurance doesn’t need louder tech. It needs smarter, quieter solutions like MAILAI, DOCAI, Smart Portals, and InsurAdmin Platform—working invisibly in the background to let humans do what they do best.